how to register income tax malaysia

To file your income tax the expatriate will need to obtain a tax number from the Inland Revenue Board of Malaysia IRB. Visit the Inland Revenue.

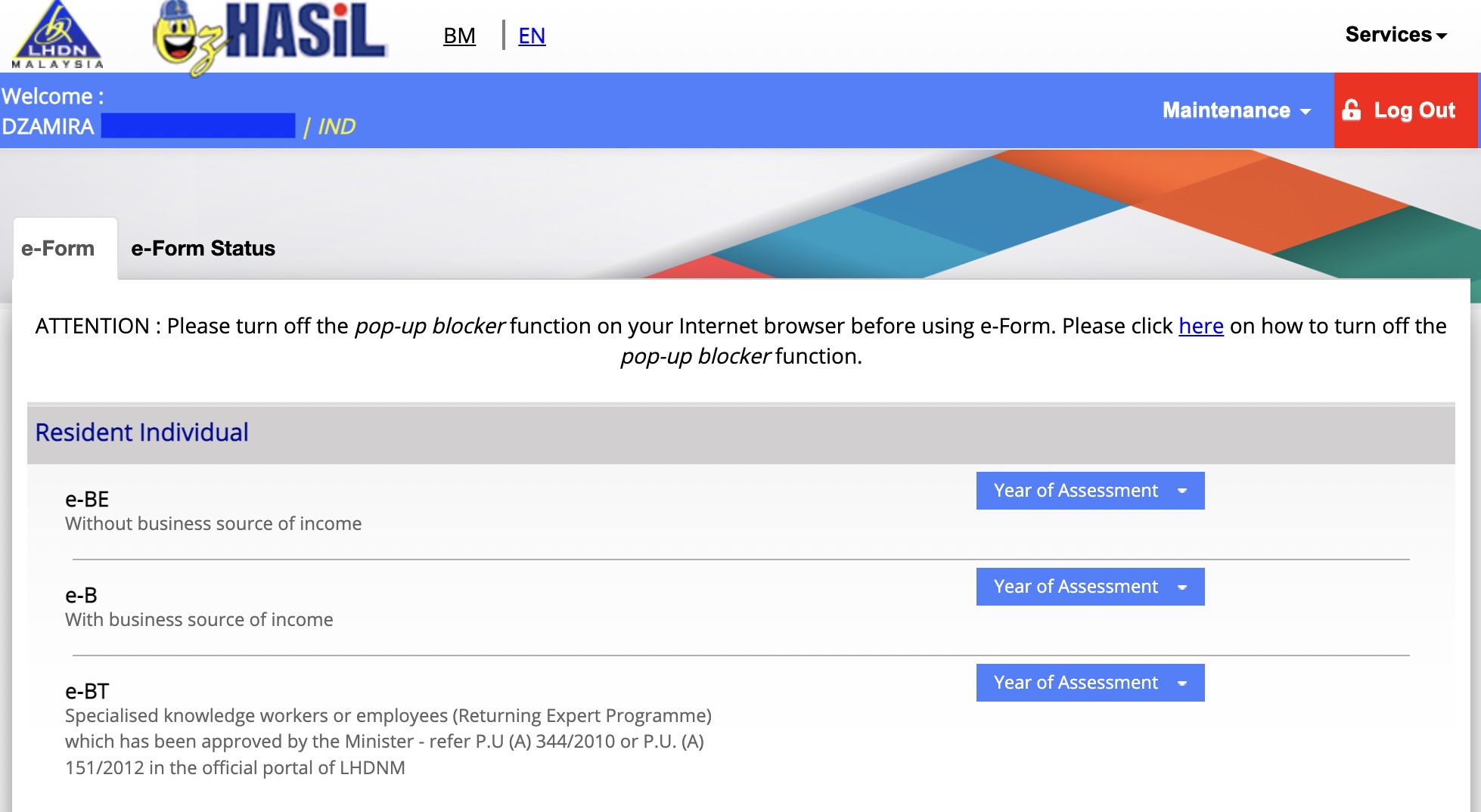

Guide To Using Lhdn E Filing To File Your Income Tax

Forward the following documents together with the application form to register an income tax reference number E-number- 1.

. Obtaining an Income Tax Number If you do not hold but require an Income Tax Number you should. Heres a more detailed. Click on Application and then e-Filing PIN Number Application at the left menu.

How to file your income tax Non-residents filing for income tax can do so using the same method as residents. Individual Life Cycle. If you plan to do this manually you can visit your LHDN branch.

You can register online through e-Daftar Or you can apply in writing to the nearest branch to your correspondence address or at any IRBM branch. Admins can complete Form CP22. Copy of up to date audited account 3.

A successful application will be issued with an approval letter and an unsuccessful application will be issued with a rejection letter accompanied by a report. If you do not have an Income Tax Identification Number but require one you should do the following. Copy of Form D The Certificate of Registration from CCM 4.

Non-residents are taxed a flat rate based on their types of income. After that you can obtain your PIN online or by visiting a LHDN branch. Normally companies will obtain the income tax numbers for.

Online e-Daftar Residence Status. Introduction Individual Income Tax. Register Online Through e-Daftar Visit the official Inland Revenue Board of Malaysia.

How to Register Tax File. Login to e-Filing and complete first-time login. Registration Steps 1.

Therell be a text box to enter your PIN number. The personal income tax rate in Malaysia is progressive and ranges from 0 to 30 depending on your income for residents while non-residents are taxed at a flat rate of around. Select the Form CP55D and complete the.

How to Declare Income. E-Daftar is a website that allows you to register online. Your name identity card number and Income Tax Reference Number will appear on.

Fill in the Personal Information Fill. Once you have the PIN head on to the e-Filing website and click on First Time Login. How do I file my tax returns.

Payments Online MTD. Copy of Identification Card Passport of Candidate Partners 2. Profession As A Tax Agent.

The employer needs to collect the Form CP39 or CP39A and fill it for an individual employee accordingly. Your income tax number and PIN to register for e-Filing the online. To get your income tax number youll need to first register as a taxpayer on e-Daftar.

Visit LHDN Website LHDN website httpsedaftarhasilgovmyindividudafsgjpnvdprdphp 2. Register at the nearest IRBM Inland Revenue Board of Malaysia or LHDN Lembaga Hasil Dalam Negeri branch OR register online via e-Daftar. Register under e-Daftar If this is your very first time youll first need to register with LHDN.

First is to determine if you are eligible as a taxpayer 2. Heres how you can apply for your PIN number online. A copy of identification cardpassport of the applicants.

Ensure you have your latest EA form with you 3. How to File Income Tax in Malaysia 2022 LHDN - YouTube. 7 Tips to File Malaysian Income Tax For Beginners Melly Ling March 24 2021 1.

To do this Browse to ezHASiL e-Filing website and click First Time Login Fill up PIN Number and MyKad Number click Submit button Review all the information click Agree Submit button. Employers then submit the drafted Forms CP39 or CP39A to the Inland. The primary function of the Inland Revenue Board of Malaysia is to provide services in administering assessing collecting and enforcing payment of income tax petroleum income.

How To File Your Taxes For The First Time

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

How To Check Your Income Tax Number

How To File Your Taxes For The First Time

First Time Taxpayer Registration Guide Income Tax Malaysia 2022 Youtube

Guide To Using Lhdn E Filing To File Your Income Tax

How To File Income Tax For The First Time

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Updated 2021 Tax Reliefs For Ya 2020 And How To File Income Tax In Malaysia Using Lhdn E Filing Iproperty Com My

How Do I Register For Tax How Do I Obtain An Income Tax Number Tax Lawyerment Knowledge Base

Offshore Tax Loophole Helps Rich Americans Cheat Irs Senate Says Bloomberg

Tis The Season To File Your Taxes Again So We Thought We D Help You Out With E Filing Rojakdaily

Malaysia Personal Income Tax First Timers E Filing Guide Youtube

Never Filed Income Tax Before Here S A Simple Guide On How To Do It Online World

Ifpa Resources Tax Planning This Workshop Will Explain In Detail And With Examples On How To Calculate Taxes In Different Situations Participants Who Serve As Wealth Management Advisors Will

Comments

Post a Comment